Introduction

When investment managers evaluate ERP options, the same names keep appearing: Microsoft D365 Finance, Oracle Cloud ERP, SAP S/4HANA, NetSuite, and Sage Intacct. Legacy players like Dynamics GP or specialized fund accounting systems round out the list.

Each has strengths. None is universally “best.” The right choice depends on your specific requirements, scale, budget, and strategic direction. But for complex, multi-entity investment managers with sophisticated consolidation, currency, and compliance needs, some platforms fit better than others.

Let’s break down the real differences.

Oracle Cloud ERP: Enterprise Power, Enterprise Complexity

Oracle has decades of experience serving the largest financial institutions in the world. Oracle Cloud ERP (formerly Oracle Fusion) represents their modern cloud offering, built to replace legacy Oracle E-Business Suite installations.

Where Oracle Does Well:

- Exceptional depth in financial management functionality

- Strong global tax engine and localization capabilities

- Robust multi-book accounting for complex statutory and management reporting

- Enterprise Performance Management (EPM) integration for planning and consolidation

- Deep analytics with Oracle Analytics Cloud.

Where Oracle Falls Short for Investment Managers:

Bottom line: Oracle makes sense if you’re a very large asset manager ($500B+ AUM) with complex global operations already invested in the Oracle ecosystem. For most investment managers, it’s more than you need at a price point that doesn’t make sense.

SAP S/4HANA: The Manufacturing Giant’s Financial System

SAP dominates manufacturing and industrial sectors. S/4HANA is their in-memory ERP platform designed to replace legacy SAP ECC systems.

Where SAP Does Well:

- Unmatched in complex manufacturing and supply chain scenarios

- Strong in industries with heavy regulatory compliance (pharma, chemicals)

- Global presence with deep localization

- Real-time analytics through HANA database

- Comprehensive business process coverage.

Where SAP Falls Short for Investment Managers:

- DNA is manufacturing: SAP’s heritage is manufacturing, logistics, and supply chain. Financial services, particularly investment management, isn’t their core focus. The product reflects this: excellent inventory management, less refined investment management workflows

- Implementation burden: SAP implementations are legendary for their duration and cost. Even S/4HANA Cloud implementations typically run 12-24 months for finance-only scope. Full deployments stretch longer

- Complexity tax: SAP’s power comes with complexity. Configuration, master data management, and ongoing administration require dedicated expertise. Most investment managers don’t want to become SAP shops

- User experience: Despite improvements in S/4HANA, SAP’s user experience still trails competitors. Finance users accustomed to modern interfaces find SAP’s screens dated

- Mid-market fit: SAP Business One targets smaller organizations but lacks the sophistication investment managers need. S/4HANA is built for enterprises. The gap leaves mid-sized investment managers without an ideal SAP option

- Cost structure: Between licensing, implementation, and ongoing administration, SAP’s total cost of ownership is among the highest in the market.

Bottom line: SAP makes sense if you’re a diversified financial services conglomerate with significant operational business (insurance operations, real estate management with physical assets). For pure investment managers, SAP’s strengths don’t align with your needs.

NetSuite: The Mid-Market Default

NetSuite has strong brand recognition in the mid-market and is often the first cloud ERP that finance teams consider. Acquired by Oracle but operated independently, it occupies a different market position than Oracle Cloud ERP.

Where NetSuite Does Well:

- Strong subsidiary management for straightforward multi-entity structures

- Good SuiteAnalytics reporting capabilities

- Mature cloud platform with solid uptime record

- Familiar to many accountants from previous roles

- Faster implementation timelines than enterprise alternatives

- Reasonable mid-market pricing for smaller entity counts.

Where NetSuite Falls Short for Investment Managers:

- Consolidation complexity: NetSuite consolidation works well for simpler structures but can struggle with the 35-50+ entity complexity of multi-boutique managers. Elimination rules are less sophisticated than D365 Finance.

- Currency limitations: While NetSuite handles multi-currency, features like dual-currency ledger (parallel reporting in two currencies) aren’t available. Investment managers who need true multi-GAAP reporting find workarounds necessary.

- Customization approach: NetSuite’s SuiteScript customization requires specialized skills. Heavy customization can create upgrade challenges and technical debt.

- Intercompany at scale: Managing high volumes of intercompany transactions across dozens of entities creates performance and administration challenges.

- Entity-based pricing: NetSuite’s per-subsidiary licensing model particularly impacts multi-entity investment managers. Costs escalate as entity count grows, unlike D365 Finance’s user-based model.

- Oracle cloud uncertainty: Long-term product direction questions persist as Oracle rationalizes its cloud portfolio. Will NetSuite remain distinct or merge with Oracle Cloud ERP functionality?

Bottom line: NetSuite works well for smaller investment managers with fewer than 15-20 entities and straightforward consolidation requirements. It becomes problematic as complexity grows.

Sage Intacct: Strong GL, Limited ERP

Sage Intacct has earned a following, particularly among firms prioritizing financial management and reporting. The GL is genuinely excellent.

Where Sage Intacct Does Well:

- Exceptional financial reporting and dimensional analysis

- Strong multi-entity and consolidation for moderate entity counts

- Good integration ecosystem for specialized applications

- True cloud architecture with modern user experience

- Reasonable implementation timelines

- Strong in professional services organizations.

Where Sage Intacct Falls Short for Investment Managers:

- Not a full ERP: Intacct is primarily a financial management system. For procurement, fixed assets, project accounting, or expense management, you need add-ons or integrations. D365 Finance includes these natively.

- Entity scale: Very large entity structures (40+) can stress the platform. Performance and administration become challenging at scale.

- Global capabilities: While Intacct has added international features, global localizations aren’t as deep as D365 Finance, Oracle, or SAP. Multi-country investment managers often need supplemental systems for statutory compliance.

- Microsoft ecosystem: Investment managers heavily using Microsoft 365 lose integration benefits when choosing a non-Microsoft ERP. Power Platform, Teams, SharePoint, and Power BI all connect more seamlessly to D365.

- Strategic investment: Sage’s strategic focus appears to be on Sage Intacct for mid-market and Sage X3 for larger organizations. Long-term product investment patterns matter for a 10+ year ERP decision.

Bottom line: Sage Intacct excels as a financial management system for investment managers with moderate complexity who don’t need full ERP capabilities. When requirements expand beyond core financials, you’ll assemble a multi-vendor solution.

Legacy Systems: Time to Move On

Many investment managers still run older Microsoft systems (Dynamics GP, Great Plains), older SAP versions (Business One, ECC), older Oracle (E-Business Suite), or other legacy platforms.

The Case for Migration:

- Cloud capabilities: Legacy on-premises systems don’t offer modern cloud benefits (automatic updates, scalability, anywhere access, reduced IT burden)

- End of support: Microsoft has announced end of mainstream support for GP, with extended support ending in coming years. Oracle and SAP similarly are pushing customers toward cloud versions.

- Talent scarcity: Fewer professionals know legacy systems. Hiring and retaining people who can maintain them becomes difficult and expensive.

- Integration debt: Legacy systems require more complex integrations with modern applications

- Compliance gaps: Older systems may lack audit trail, workflow, and security capabilities that modern compliance requires.

D365 Finance: Built for Complexity

Microsoft Dynamics 365 Finance was designed from the ground up for medium, large, complex, global organizations. It’s the ERP that Microsoft built when they decided to compete at the enterprise level.

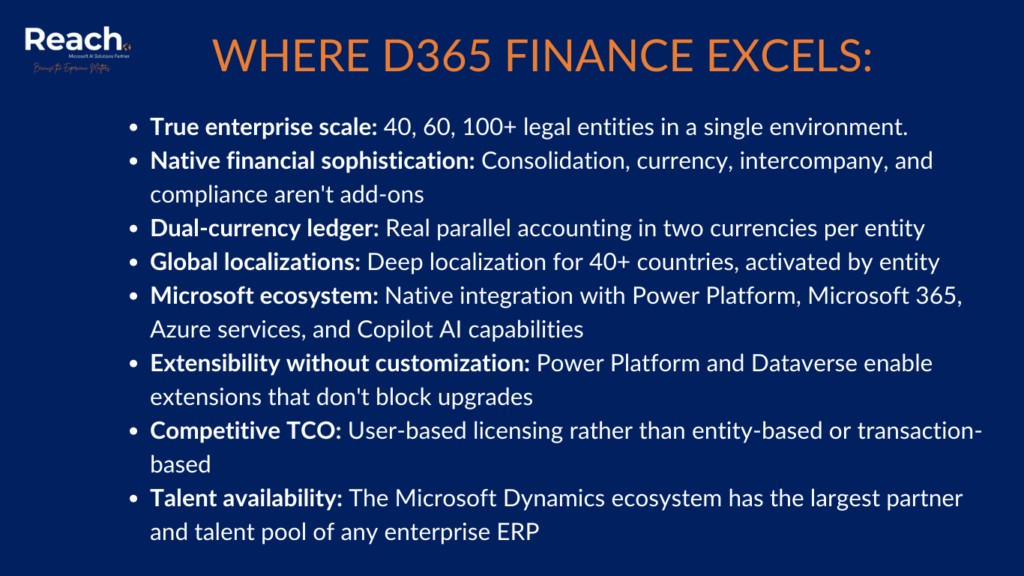

Where D365 Finance Excels:

- True enterprise scale: 40, 60, 100+ legal entities in a single environment

- Native financial sophistication: Consolidation, currency, intercompany, and compliance aren’t add-ons

- Dual-currency ledger: Real parallel accounting in two currencies per entity

- Global localizations: Deep localization for 40+ countries, activated by entity

- Microsoft ecosystem: Native integration with Power Platform, Microsoft 365, Azure services, and Copilot AI capabilities

- Extensibility without customization: Power Platform and Dataverse enable extensions that don’t block upgrades

- Competitive TCO: User-based licensing rather than entity-based or transaction-based

- Talent availability: The Microsoft Dynamics ecosystem has the largest partner and talent pool of any enterprise ERP

The Investment Management Fit

For complex investment managers specifically, D365 Finance advantages include:

Multi-Boutique Support: Each boutique can have its own chart of accounts, dimensions, and reporting while still consolidating to the parent. The architecture handles the autonomy-with-oversight balance that multi-boutique structures require.

Fund Structure Flexibility: Financial dimensions can track fund families, strategies, vehicles, and other investment management constructs without custom development.

Compliance Infrastructure: SOX, SOC, GDPR requirements are addressed through core platform capabilities, not bolted-on modules.

Intercompany at Volume: Management fee processing, distribution fee allocation, shared service charging, and other high-volume intercompany activities process efficiently with automatic elimination.

Microsoft 365 Integration: Most investment managers already use Microsoft 365. D365 Finance integrates natively with Excel, Teams, SharePoint, and Outlook in ways that feel seamless rather than bolted on.

Head-to-Head Comparison

| Capability | D365 Finance | Oracle Cloud | SAP S/4HANA | NetSuite | Sage Intacct |

| Multi-entity at scale (40+) | Excellent | Excellent | Excellent | Challenging | Challenging |

| Consolidation sophistication | Excellent | Excellent | Good | Good | Good |

| Dual-currency ledger | Yes | Yes | Yes | No | No |

| Implementation timeline | 9-15 months | 18-30 months | 12-24 months | 4-9 months | 4-8 months |

| Microsoft ecosystem fit | Native | Poor | Poor | Moderate | Moderate |

| AI/Copilot capabilities | Native | Separate | Separate | Limited | Limited |

| Power Platform integration | Native | None | None | Limited | Limited |

| Mid-market pricing | Good | Poor | Poor | Good | Good |

| Global localizations | 40+ countries | 50+ countries | 50+ countries | 25+ countries | 20+ countries |

| Talent availability | High | Medium | Medium | Medium | Medium |

| Full ERP capabilities | Yes | Yes | Yes | Yes | Limited |

When Others Might Fit Better

D365 Finance isn’t always the right choice:

Very small firms: If you have 5 entities and 15 users, D365 Finance may be overkill. NetSuite or Intacct might be more appropriate.

Oracle or SAP invested: If you’ve already made significant Oracle or SAP investments elsewhere in the organization, staying in that ecosystem may make sense despite the disadvantages.

Specialized fund accounting priority: If your primary need is fund accounting (NAV calculation, investor allocations, capital calls), specialized fund administration software may be a better fit, with D365 Finance or another ERP for corporate accounting.

Speed over capability: If you need to be live in 4 months with basic needs and have limited complexity, NetSuite or Intacct might get you there quicker.

Making the Decision

Steps for a sound ERP decision:

- Document your requirements. Not features you’d like to have, but actual business requirements. What do you absolutely need to operate?

- Weight the requirements. Some requirements are critical. Others are nice-to-have. Force-rank them.

- Evaluate fit against requirements. Score each platform against your weighted requirements. Don’t rely on vendor claims. See it demonstrated.

- Model total cost of ownership. Include licensing, implementation, internal resources, integrations, and 5-7 years of operation and enhancement.

- Check references. Talk to investment managers running each platform today. Ask about pain points, not just successes.

- Consider the future. Where will your firm be in 5 years? 60 entities? New countries? Different regulatory requirements? Choose a platform that can grow with you.

Conclusion

Oracle and SAP serve the largest enterprises with the deepest pockets and most complex global operations. NetSuite and Sage Intacct serve smaller, simpler organizations that prioritize fast implementation over comprehensive capability.

D365 Finance occupies the space between: enterprise capability without enterprise complexity and cost. For multi-boutique investment managers with 20-100+ entities, sophisticated currency and consolidation needs, and rigorous compliance requirements, D365 Finance provides the most complete foundation at a reasonable total cost of ownership.

The investment in D365 Finance is larger upfront than NetSuite or Intacct, but smaller than Oracle or SAP. For firms that will grow, expand globally, or face increasing regulatory scrutiny, it’s the platform that balances capability, cost, and future flexibility.

Ready to Modernize Your Finance Operations?

Don’t let legacy systems and manual spreadsheets hold back your firm’s growth. Whether you are managing 10 entities or 100, our Finance and Supply Chain Management services are designed to help investment managers unlock the full potential of Microsoft Dynamics 365.

How We Can Help:

- Custom Implementation: Transition from manual processes to an automated, multi-entity environment tailored to PE and investment boutique needs.

- Consolidation Strategy: Design a “single source of truth” for real-time reporting across all fund families and jurisdictions.

- Managed Services: Ongoing support to ensure your system evolves alongside changing regulatory requirements and new fund launches.

Next in this series: Blog 6: The Microsoft Platform Advantage: Power Platform and Copilot.