Introduction

As an investment manager, you operate under regulatory scrutiny that most businesses never experience. SOX compliance, SOC audits, SEC examinations, GDPR data protection requirements, and regulatory filings across multiple jurisdictions all create demands on your financial systems.

Your ERP isn’t just a transaction processing system. It’s evidence of control. Auditors and regulators expect to see that your financial systems enforce the controls your policies describe.

What the Data Says: The Compliance Burden

Recent research from Gartner and McKinsey highlights that regulatory pressure is no longer just a legal hurdle—it is a significant driver of operational cost and executive risk.

- The Cost of Non-Compliance: According to Gartner, the average cost for organizations to comply with data privacy regulations (like GDPR) is now roughly $2 million annually, but the cost of non-compliance—including fines, remediation, and reputational damage—can be three times higher.

- Audit Efficiency: A McKinsey survey on finance excellence found that firms using automated compliance workflows spend 25% less time on audit preparation and internal controls testing compared to firms relying on manual documentation.

- The “Regulatory Resilience” Gap: Gartner’s 2025 Audit Priorities report indicates that 74% of CFOs are concerned about their team’s ability to keep up with the volume of regulatory change without modernized system support.

The SOX Reality

Public investment managers subject to Sarbanes-Oxley need to demonstrate effective internal controls over financial reporting. This isn’t just about having policies. It’s about systems that enforce those policies.

Key system requirements for SOX compliance:

Segregation of Duties: The person who creates a vendor shouldn’t be able to approve payments to that vendor. The person who enters journal entries shouldn’t be able to post them without approval. D365 Finance role-based security and workflow enforce these separations at the system level, making violations impossible rather than relying on training and discipline.

Approval Workflows: Material transactions require documented approval. D365 Finance workflow routes documents based on configurable rules (amount thresholds, expense types, cost centers) and records who approved, when, and what version of the document they approved.

Audit Trail: Every transaction and every master data change is logged. Who created it, when, from what workstation, and any subsequent modifications. D365 Finance maintains this audit trail automatically without user action.

Period Controls: Once a period is closed, it should stay closed. Unauthorized posting to closed periods is a classic audit finding. D365 Finance period close functionality controls posting eligibility by date, module, and user group.

The SOC Report Conversation

Your customers and investors want assurance that their data and assets are protected. SOC 1 and SOC 2 reports provide that assurance.

SOC 1: Relevant for controls that impact customer financial reporting. As an investment manager, the controls around your financial systems affect your fund financials, which affect your investors.

SOC 2: Relevant for security, availability, processing integrity, confidentiality, and privacy. How you protect data and systems matters.

D365 Finance runs on Microsoft Azure, which maintains its own SOC reports covering the infrastructure layer. But you’re still responsible for application-level controls. The good news is that D365 Finance provides the tools to implement and demonstrate those controls.

When auditors test your controls:

- They can query the audit log directly

- They can see workflow approval history on any document

- They can test that security roles actually prevent the actions they’re supposed to prevent

- They can verify that system-enforced controls can’t be bypassed.

GDPR and Data Protection

Investment managers with European investors, employees, or operations need to comply with GDPR. This affects your ERP in several ways:

Data Residency: Where is the data physically stored? D365 Finance on Azure offers data residency options that can align with GDPR requirements for where European personal data is processed.

Right to Erasure: Individuals can request deletion of their personal data. D365 Finance includes data purging capabilities that can be configured to comply with these requests while maintaining necessary audit records.

Access Rights: Individuals can request their personal data. D365 Finance provides tools to identify and export personal data associated with a specific person.

Data Minimization: Don’t collect more data than needed, don’t retain it longer than necessary. Configurable retention policies help enforce data minimization principles.

Workflow That Actually Works

Compliance depends on approval workflows that people actually use. If workflows are too cumbersome, people find workarounds. If they’re too loose, controls are ineffective.

D365 Finance workflow is configurable to match your business requirements:

Conditional Routing: Route for approval based on amount, type, department, or any field value. Small transactions might auto-approve while larger ones require multiple approval levels.

Delegation: Handle planned absences with delegation. Approvers can assign their authority temporarily without breaking the workflow.

Escalation: Automatic escalation if approvals aren’t completed within specified timeframes.

Mobile Approval: Approvers can act on work items from mobile devices, reducing bottlenecks from people who are traveling.

Parallel vs. Sequential: Some approvals need multiple people in sequence. Others can happen in parallel. Workflow supports both patterns.

Document Management and Electronic Signatures

Compliance often requires retaining source documents and demonstrating who approved what.

D365 Finance document management:

- Attaches source documents (invoices, contracts, receipts) directly to transactions

- Links documents stored in SharePoint or other repositories

- Records document metadata (upload date, user, document type)

- Preserves documents through the full transaction lifecycle.

Electronic signatures provide evidence of approval beyond workflow:

- Users authenticate to apply electronic signatures

- Signature records include timestamp, user ID, and IP address

- Signature history is maintained even if the underlying document changes.

Audit Preparation

Regular audits are a fact of life for investment managers. External financial statement audits, SOC audits, SEC examinations, and internal audits all require evidence from your financial systems.

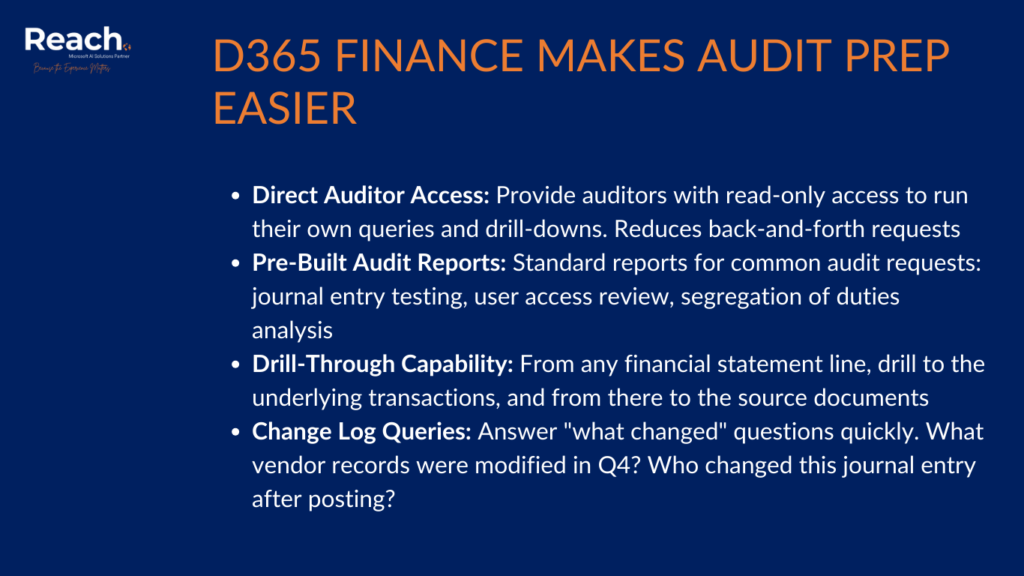

D365 Finance makes audit prep easier:

- Direct Auditor Access: Provide auditors with read-only access to run their own queries and drill-downs. Reduces back-and-forth requests

- Pre-Built Audit Reports: Standard reports for common audit requests: journal entry testing, user access review, segregation of duties analysis

- Drill-Through Capability: From any financial statement line, drill to the underlying transactions, and from there to the source documents

- Change Log Queries: Answer “what changed” questions quickly. What vendor records were modified in Q4? Who changed this journal entry after posting?

Global Regulatory Requirements

Multi-national investment managers face regulatory requirements in each jurisdiction:

- US: 1099 reporting, W-9 collection, sales and use tax nexus, SEC filings

- UK: Making Tax Digital, Companies House filings, FCA reporting

- EU: VAT, GDPR, local statutory requirements

- Singapore: GST, ACRA filings, MAS requirements.

D365 Finance localization features activate based on each legal entity’s country. Local regulatory reports, tax calculation rules, and compliance features enable without requiring separate country-specific systems.

Building Compliance Culture

Technology enables compliance but doesn’t guarantee it. The most sophisticated system can be undermined by workarounds, policy exceptions, and cultural acceptance of non-compliance.

D365 Finance helps build compliance culture by:

- Making the right thing the easy thing (workflow that doesn’t obstruct work)

- Making the wrong thing the hard thing (security that prevents violations)

- Providing visibility (dashboards that show compliance status)

- Creating accountability (clear audit trails that answer who, what, when).

Conclusion

Investment managers can’t treat compliance as a cost center to minimize. Regulatory failures create existential risks to the business. The right ERP makes compliance a byproduct of normal operations rather than an additional burden.

D365 Finance provides the audit trails, controls, and compliance infrastructure that investment managers need. It’s not about checking boxes. It’s about building financial systems that you can confidently stand behind when regulators and auditors arrive.

Ready to Modernize Your Finance Operations?

Don’t let legacy systems and manual spreadsheets hold back your firm’s growth. Whether you are managing 10 entities or 100, our Finance and Supply Chain Management services are designed to help investment managers unlock the full potential of Microsoft Dynamics 365.

How We Can Help:

- Custom Implementation: Transition from manual processes to an automated, multi-entity environment tailored to PE and investment boutique needs.

- Consolidation Strategy: Design a “single source of truth” for real-time reporting across all fund families and jurisdictions.

- Managed Services: Ongoing support to ensure your system evolves alongside changing regulatory requirements and new fund launches.

Next in this series: Blog 5: D365 Finance vs. NetSuite, Sage, Oracle, and SAP.