Part 1 of 6: From Dual Systems to Single Source of Truth

Our Fintech client recently navigated a long merger process that was poised to help the company accelerate its growth and sell into new markets. The leadership team was excited to begin integrating the processes and systems across both companies and identify new opportunities, but they were quickly faced with a question that would determine the next four years of their business operations: Which of the two companies’ CRM system survives?

Unlike typical M&A scenarios where a larger parent company absorbs a smaller subsidiary, our client was born from the merger of two equally sized companies. The first one had 56 users on Salesforce and the second had 52 users on Dynamics 365.

But the real challenge wasn’t the numbers—it was everything else.

The “Equal Merger” Problem

In most technology consolidations, size dictates the decision. The bigger system wins, and the smaller team adapts. But when you have two established user bases of nearly identical size, each with their own workflows, customizations, and deeply ingrained habits, the decision becomes exponentially more complex.

The Competing Factors:

- Executive Preferences: The incoming CRO was a Salesforce champion and conference speaker

- Existing Investment: Dynamics 365 already contained extensive company-specific functionality

- User Resistance: Both teams were passionate about their chosen platforms

- Time Pressure: Licensing contracts were expiring, forcing a decision

Beyond the Surface: What the Numbers Really Revealed

The first step was a comprehensive audit of both systems. What the team discovered was shocking:

Salesforce System:

- 869 reports for 56 users (15+ reports per user)

- Heavy customization with questionable architecture

- Excellent integration with call center technology

- Superior field validation and data entry controls

Dynamics 365 System:

- 86 unmanaged solutions (concerning but manageable)

- Deep, industry-specific partner validation workflows

- Robust integration with verification services

- Comprehensive audit trails for compliance

The 869 reports number was particularly revealing. When the team dug deeper, they discovered that many were duplicates—different versions of the same report created over time due to poor initial implementation practices. What looked like sophisticated reporting was actually a symptom of underlying system issues.

The Methodology That Saved the Project

Rather than letting politics or preferences drive the decision, the team established a systematic evaluation framework:

1. Stakeholder Authority Mapping

Who actually had decision-making power? This wasn’t as obvious as it seemed. The CRO had opinions, but did he have ultimate authority? The team required written documentation of the decision-making hierarchy before proceeding.

2. Business Process Analysis

Instead of starting with features, they mapped out actual business processes. For a fintech company publishing debit and gift cards, the most critical processes involved:

- Multi-level partner and distributor validation

- Regulatory compliance workflows

- Integration with verification services like LexisNexis and D&B

3. Total Cost of Ownership Assessment

Beyond licensing fees, they calculated:

- Migration effort and timeline

- Training and change management costs

- Lost productivity during transition

- Ongoing maintenance and enhancement costs

4. Risk Assessment

What could go wrong, and how bad would it be?

- Data migration failures

- User adoption resistance

- Regulatory compliance disruption

- Integration breakdown

The Surprising Decision

Despite the CRO’s strong Salesforce preference and the platform’s technical advantages in certain areas, the data pointed toward Dynamics 365. Why?

The Decisive Factor: Unique Business Logic

The Dynamics 365 system already contained millions of dollars worth of fintech-specific functionality that would be prohibitively expensive to recreate in Salesforce. The partner validation workflows, compliance approval processes, and verification service integrations were deeply embedded in the platform.

As one team member simply put it: “We could spend two years and millions of dollars rebuilding what we already have, or we could spend six months making what we have work for everyone.”

The Framework That Works

For organizations facing similar decisions, here’s the evaluation framework that proved successful:

1. Quantify the Invisible

Don’t just count users and features. Measure:

- Custom functionality depth

- Integration complexity

- Data migration effort

- Change management requirements

2. Map Decision Authority

Clearly document who makes what decisions and require written sign-offs on recommendations.

3. Business Process First

Start with “How do we actually work?” not “What features do we need?”

4. Total Cost Reality

Include soft costs like training, productivity loss, and ongoing maintenance.

5. Risk Mitigation Planning

Identify what could go wrong and have contingency plans ready.

Unlock smarter decision-making

Download our Fintech Evaluation Checklist to confidently choose the right solution for your business.

What’s Next?

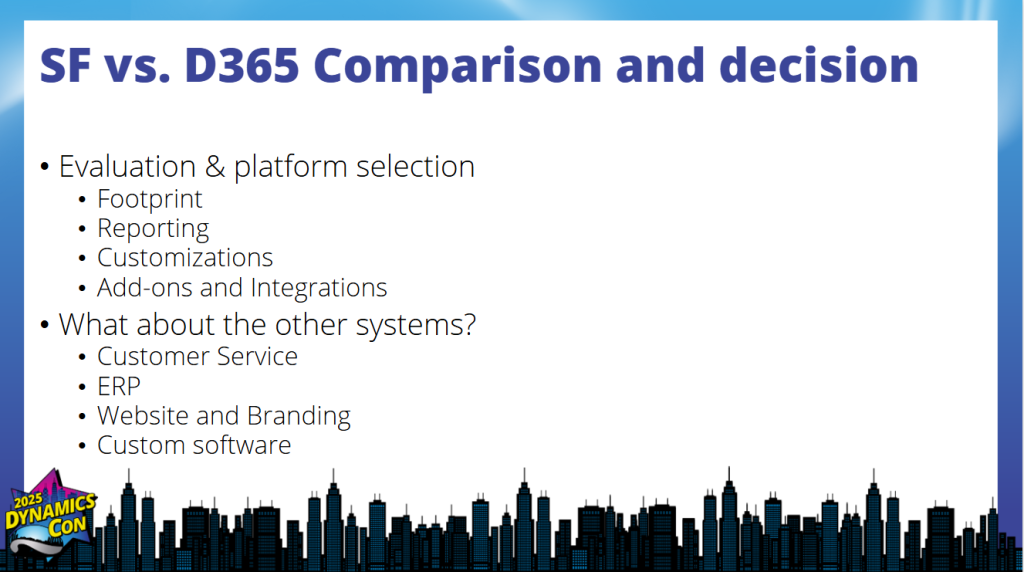

The decision was just the beginning. In our next post, we’ll dive deep into the actual platform comparison—beyond the marketing brochures to the real-world strengths and weaknesses of Salesforce vs. Dynamics 365 for fintech companies.

We’ll explore why neither platform is universally “better” and share the comparison framework that helped Fintech make an informed decision despite competing against stakeholder preferences.

Coming up in Part 2: “Salesforce vs Dynamics 365: The Real Comparison” – An honest assessment of each platform’s strengths and the decision framework that actually works.

Are you facing a similar challenge? Let’s talk.